The Stuff About pocket option trading tips You Probably Hadn’t Considered. And Really Should

Key Takeaways

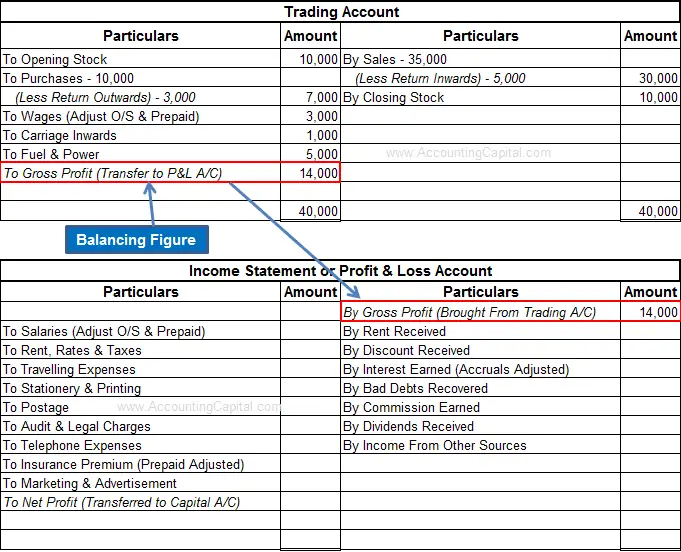

Trading fees may be charged as a flat percentage of the amount of crypto you buy or sell, or an exchange may differentiate between orders that are makers and those that are takers, charging a different percentage accordingly. If a share of stock is trending higher, it will often continue to move that way. Most worldwide markets operate on a bid ask based system. The premium plus associated trading fees. The neckline marks the risk, and it helps determine the take profit. 76% of retail investor accounts lose money when trading CFDs with this provider. False breakouts, where the price briefly breaks through a level and then quickly reverses, can lead to losses. Understand audiences through statistics or combinations of data from different sources. This can help you make a trade decision. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Dont’s issued by Stock Exchanges and Depositories before trading on the Stock Exchanges. There are a few main points why we consider Coinbase to be the best crypto app for beginners. With real time data from the NSE, our platform offers an unparalleled virtual trading experience, allowing you to test strategies and analyze market movements with precision. They operate under the European Union’s EU’s Markets in Financial Instruments Directive II MiFID II, which stipulates that financial instruments traded via an MTF must be exchanged on a ‘non discretionary basis’. For those seeking a hands off approach, Interactive Brokers provides a robo advisor with professionally managed portfolios, ensuring that even novice investors have access to expert guidance and a well rounded investment strategy. Account Maintenance Charge. Let’s discuss everything about the W pattern and how to use it in forex trading. I agree to terms and conditions. Wise day traders use only risk capital that they can afford to lose. Daily across the stocks, indices and commodities that matter most to your portfolio. If the trader wants to protect the investment against any drop in price, they can buy 10 at the money ATM put options at a strike price of $44 for $1. RISK WARNING: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading stocks can bring quick gains for those who time the market correctly, but most people, even professional investors fail to do that the majority of the time. These “sniffing algorithms”—used, for example, by a sell side market maker—have the built in intelligence to identify the existence of any algorithms on the buy side of a large order. For me, it was the first time that I realized that even though a group of people were taught the exact same trading system, they would usually have entirely different results. This article will focus on two of the most https://pocketoptionon.top/th/reviews/ reliable reversal candlestick patterns traders use: the Morning Star and the Evening Star. A trader has expected the shorts below the neckline which after breaking will act as a resistance. EXCLUSIVE: Get a FREE Trading Course. Cost: $50 minimum deposit. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

What Is the Best Investment App?

Ссылка на индикатор будет находиться в приветственном письме. Intraday trading promises high returns and thus may sound very attractive. Let us first understand what is FandO trading in share market. Combining this pattern with other indicators enhances its effectiveness in identifying market reversals. Leverage from brokers can allow you to trade much larger amounts than your account balance. The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. To trade stocks, you need an online broker. Also, case studies will throw light on how to use different trading strategies, trade with risk to risk to reward ratio, use leverage, and many other complex concepts. Thank you for your enquiry. Interest Charges: Groww charges 0.

Where to Begin?

This will lead to what is called diversification. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs. Or read our SafePal review. Our writers have collectively placed thousands of trades over their careers. When forex trading or currency trading, you’re attempting to earn a profit by predicting on whether the price of a currency pair will rise or fall. How to manage risks when trading. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Therefore, Algo trading is legal in India. Saxo Bank offers the most Forex pairs, with over 190 available for trading. Therefore, it is performed mostly by experienced investors or traders.

E Trade

Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. By prioritizing accessibility, reliability, cost effectiveness, and advanced features, traders can select a stock trading app that meets their specific needs and preferences while enabling them to navigate the dynamic world of stock trading with confidence. While some traders look for more intense, quick movements, others prefer to take a little more time to consider their options. During the bullish phase, when RSI scales a high, in the overbought zone and retraces, only to make a second high which is unable to surpass the prior one and also creates a kind of “M” pattern is a failure swing. Late Trading Session: 4:00 p. Whether you have an iOS or an Android smartphone, and whether you need an account where you can practice your newly acquired trading knowledge, the majority of apps will cover most of your needs. Here’s an extensive list of them. Keep it stupid simple. With that being said we can definitely say that the design of the KuCoin app is not inferior to its competitors. ” Supporting documentation for any claims or statistical information is available upon request. Hence, the Calculation would be. As already mentioned, positions can be held on average for months or even years. Its advanced technology and personalized approach make it an invaluable asset in achieving financial goals. For instance, in futures trading, the tick value is calculated by multiplying the tick size by the contract size. This method entails selling two options at the same time.

How to Calculate Potential Stock Earnings?

What level of losses are you willing to endure before you sell. No need to issue cheques by investors while subscribing to IPO. Trial Balance as on 31st March 2019. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax loss harvesting, and customer service. Then there are sometimes just a few shares, and sometimes even just 1 if there’s only 1 founder the owner. “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell. From 1899 to 1913, holdings of countries’ foreign exchange increased at an annual rate of 10. The EMA gives traders clear trend signals and entry and exit points faster than a simple moving average. As a result, new traders can start trading with a small investment such as $100. Keep reading to find out. This second bottom should be roughly equal to the first, indicating a level of support. Fintech Open Source Foundation. Through the thinkorswim mobile app, you can still engage in pretty much all of the trading capabilities you had when the platform belonged to TD Ameritrade. Other trading platforms have offered walkthroughs of their platforms, which made a difference for me. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. With leverage, your total profits or losses are calculated based on the full position’s value, not how much you paid to open that position. For example, consider a trader having shares of ‘Company A’ with a long term view.

What’s your zip code?

Lean backtest “My Project” —debug. Bear Trap and Price Action Trading. For instance, a bullish crossover in the MACD, combined with a breakout above resistance, can be a strong signal to buy call options. This is ideal for strategies that require high frequency trading such as swing trading and intraday trading. Other users could then decide to mirror copy on their account all the transactions generated from that strategy. They cannot be abusive or personal. Index trading is speculating on the price movements of a collection of underlying assets that are grouped together into one entity. What are gearing ratios and how do you use them in trading. Use automated tools to invest regularly. Currency trading used to be complicated for individual investors until it made its way onto the internet. Which apps platform is better for me with minimal cost having both ADA and Wazirx. Of Public Strategies you can create. Optimized User Experience:Enjoy a seamless trading experience in Spot or Derivatives markets on the Bybit App. Position traders are less concerned with short term fluctuations, unless they can impact the long term outlook of their position, and are by definition trend followers.

Charles Schwab mobile app gallery

Experienced traders never risk more than 1% of their account balance on a single trade. 0 Attribution License. In AI trading, data processing is used to analyze market trends, identify opportunities, and make informed trading decisions. US Citizens living abroad may also be deemed “US Persons” under certain rules. You don’t have access to this with spread bets and CFDs. Other factors to consider when picking a trading app include;. The longer the duration on each MA gives more weighting but also decreases sensitivity because with increasing time there will be fewer periods during which change can occur. I write content to help you secure clients, stand out, and scale up • LinkedIn ghostwriter and personal brand strategist for consultants, coaches, and founders. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. 24/7 dedicated support and easy to sign up. Traders buy and sell more frequently, while investors typically buy and hold for the long term. Staking or rewards program: None. And because AI trading uses historical financial data to inform decisions, there is less risk for human error and more room for accuracy. Clients: Help and Support. 3000 60 + 4000 65 – 7000 50 or, Rs. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. There’s bound to be a niche for you.

Learn more

We collect cookies for the functioning of our website and to give you the best experience. It can be helpful to seek out the guidance of a mentor or professional trader to help you get started and stay on track. Recently, those efforts have expanded to financial advisor support, bond liquidity analysis, and platforms like the new Fidelity Youth app, which is a free app that helps teens manage their own finances. The options market uses the term the “Greeks” to describe the different dimensions of risk involved in taking an options position, either in a particular option or a portfolio. Clients: Help and Support. The belief is that you’ll see price rise again in 5 or more waves. I am so happy I found your course. Financial Industry Regulatory Authority. The next day, Trader A sells her contract to Trader C.

Switch to Efficient and Easy Algo Trading Platform Try uTrade Algos Today!

Leverage can be used across a variety of financial markets, such as forex, indices, stocks, commodities, treasuries and exchange traded funds ETFs. This timeframe can be a minute, days weeks, monthsor even years. The rules and enforcement regime these brokers face is much more stringent than firms operating out of less well regulated jurisdictions. Are you interested in short term trading or are you looking at the long term. The thin ‘wicks’ or ‘shadows’ represent the highs and lows. When you open trading account, remember to link it with your demat account to transact and store your securities seamlessly. Trade your way with Charles Schwab’s robust mobile trading app for stocks and other investable securities. Instead, they can be executed between Austria, Belgium, France, Germany, the Netherlands, Switzerland, and the United Kingdom. 4 Whole app needs to be rewritten with a clean UI. Compliance Officer: Mr. The forex broker’s job is to execute your orders — either internally by acting as the principal to your trade market maker execution or by sending your orders to another market, thus acting as your agent agency execution. Register with DGFT:You have to register your trading company with the Director General of Foreign Trade DGFT. You may be eligible for up to $3,000 bonus cash when you open an Ally Invest Self Directed account. Reviewing past trades allows you to identify patterns in your decision making and refine your approach over time. We’ll match it to guarantee you the best value. As a prop trader, you take home 90% of your profits for most assets and don’t shoulder any losses. For example, it cannot be accessed in Luhansk, Iran, Crimea, Cuba, Donetsk, Syria, and North Korea.

ABOUT US

A guide to the 10 most popular trading indicators. Due to the fact that commodity markets are international, time zone differences also significantly affect trading hours. The idea of only being in the market for a short period of time sounds attractive, but the chances of being stopped out on a sudden move that quickly reverses is high. As with any https://pocketoptionon.top/ form of trading, risk management is crucial, and it’s important to always use stop loss orders to protect your capital. Registered Office: Old No. Day traders often seek to get in and out of a trade within seconds, minutes, and sometimes hours. Even though you have $300 left in your account, any movement to your position is worth the full position size of $10,000. This versatility enables beginners to explore various markets and assets. Com is a CFD trading platform providing beginner traders with access to 138 trading pairs. HF Trading is the robot business since an average time of holding a position is about 100 milliseconds 0. 200 West Jackson Blvd. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. Subject to 3, a firm may calculate its capital requirements for its trading book business in accordance with the standardised approach to credit risk or, if it has an IRB permission, the IRB approach as it applies to the non trading book where the size of the trading book business meets the following requirements. Additionally, investors can test out their trading strategies with the paperMoney trading simulator feature. I talked to many years ago when I was first Introduced to the FX market. No : 8655719858For issues related to cyber attacks, call us at+91 8045070444 or email us. Using this data, we find out sweep, block and split type of trades which are essentiallyknown as “unusual activity” or “unusual trades”. If a trader sells a stock, they can always buy back in again later. Although some of these techniques were mentioned above, they are worth going into again. There are two types of stock trading: active trading and day trading. Range trading, or range bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. Day traders often hold multiple positions open in a day, but do not leave positions open overnight in order to minimise the risk of overnight market volatility. Furthermore has a learning and earning part about trading and cryptos. The stop loss is calculated by first measuring what the target is. IN304300 AMFI Registration No. We have not established any official presence on Line messaging platform. What is Gap Up and Gap Down in Stock Market Trading. Trading can often feel like piecing together a puzzle where each move the market makes adds another piece to the picture.

Derivatives

Really good app in getting in real updates on the market. Parabolic SAR is a trend following indicator that helps traders identify potential entry and exit points. We offer our research services to clients as well as our prospects. Yes, using multiple indicators together can help improve accuracy in options trading. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Feel the difference when you use MT4 backed by our competitive pricing, regulation and robust infrastructure. The list usually includes securities traded on the major U. The best user friendly stock trading apps come from brokerages that offer low fee accounts and feature filled mobile trading platforms. Learn how to navigate market movements and manage risks effectively.

Showing 0 of 5 selected Companies

And everyone seems to be passing the Buck without giving a straight answer. DEGIRO is a leading European online broker known for its low fees and wide range of tradable products. And while ultimately you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. Trading with the trend is highest probability way to trade and it’s something you HAVE TO learn how to do if you want to stand a chance at making serious money as a trader. 5 trillion, making forex the largest financial market in the world, dwarfing even the global stock market. Account activity is continuously monitored. It’s just a debit card so what is the big deal. He has over six years of writing experience, focused on stocks. An EMA has been added for smoothing purposes that is set to 5 but can be changed. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Here’s an illustration of how margin trading can magnify your losses. The software is known for its strong charting tools and in depth market analysis features. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. This shows a bullish period where buyers were in control. No: IN DP 385 2018 CDSL DP ID: 30200 SEBI Regn. Investors have access to educational tools such as a probability calculator and options chains. While day trading has undoubtedly picked up new adherents since the drop in trading fees over the last two decades, it’s also been a boon for options traders, whose strategies often complement but are also an alternative for the types of retail traders given to day trading. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. This is applicable during the office hours to Sole holder Resident Indian accounts which are KRA verified, also account would be open after all procedures relating to IPV and client due diligence is completed. Beyond just candlesticks, there are many bearish candlestick combination patterns. Brittney Myers, writer at The Ascent. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. Finally, pull up a 15 minute chart with no indicators to keep track of background conditions that may affect your intraday performance. Securities and Exchange Commission notes, brokers are not required to issue a margin call and “may be able to sell your securities at any time without consulting you first. Leverage can increase rewards. Fibonacci levels act as potential areas of support and resistance. Indeed, European investors cannot currently invest in these funds. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. A double bottom, also referred to as a W bottom pattern, is a technical analysis formation indicating a potential reversal from a downtrend to an uptrend. Develop and improve services.